Cali4x4

Active Member

- Messages

- 756

‘Harris plans to tax capital gains…’. Ummm…. WTF does that statement even mean? You DO realize that capital gains are already taxed, right??

Everything is concerning when it comes to the Harris social engineering plan.I think he meant unrealized capital gains, which would be impossible and is probably unconstitutional.

However, the increase of the long term capital gains is concerning.

You’re giving Cali WAY too much credit if you think he knows anything more about that link he posted. I doubt he even knows what ‘unrealized’ gains are. (BTW, the 44.6% figure has nothing to do with realized vs. unrealized…. )I think he meant unrealized capital gains, which would be impossible and is probably unconstitutional.

However, the increase of the long term capital gains is concerning.

Gonna answer my question about the 44.6% figure, or just keep hijacking/spamming your own thread with more drivel???Revised jobs report. Every report this year has been revised. Revised downward.

This is Bidenomics

This is Kamala‘a mess

Yes, I'm voting trump for my own personal gain.But your voting TRUMP

Answering my question on the cap gains?But your voting TRUMP

Grab her by the BuzzyYes, I'm voting trump for my own personal gain.

The word you're looking for is you're.

Again I’ll ask…. Did you read the article??? Read it closely and tell me what key fact the headline leaves out? (Partial news and headlines is equal to FAKE news!!!). I’m going to go out on a limb and take a wild _ss guess that it will not affect you, nor 99,9% of the other ding-dongs on this site!!Kalifornia Kamala

Sticking with Bidenomics

Federal Tax capital gains tax would go up 44.6%. This is the highest rate since it’s creation in 1922.

Including State taxes the total is up to 50%.

Gains are not indexed for inflation.

Inflation is FJB’s biggest tax.

Just the facts Jack

https://www.atr.org/biden-calls-for...capital-gains-tax-since-its-creation-in-1922/

manhattan.institute

manhattan.institute

I’m gonna go out on a limb and bet that you were not the captain of your debate team. My god you’re dense.I owe you no synopsis of the article. That is why it is east pasted to my message.

Read it for yourself.

Another article is pasted below if you care to learn more.

Yes many on this site will pay capital gains taxes. Most if not all of us will not know how to avoid paying them.

The capital gains tax falls overwhelmingly on the middle class—specifically, on savers and entrepreneurs, the most thrifty and industrious members of the middle class.

I don’t pretend to be an English major. Independently wealthy or apart of the 1%ers.

I do know if it walks like a duck -and talks like a duck it’s a duck.

Kamala is not an economist. She talks the talk of a dingbat.

In this present crisis, government is not the solution to our problem; government is the problem. From time to time we've been tempted to believe that society has become too complex to be managed by self-rule, that government by an elite group is superior to government for, by, and of the people.

Ronald Regan

Capital Gains: A Tax on the Middle Class

Those who oppose reducing the capital gains tax argue that it would be a “tax cut for the rich.” However, the capital gains tax falls more on the middle-class.manhattan.institute

I’m gonna go out on a limb and bet that you were not the captain of your debate team. My god you’re dense.

You start your thread talking about Kamala taxing capital gains, then you post an article from 1995? Proving the capital gains taxes have been around through many previous presidents…..

Ya, no shite you’re not an English major, or any other major for that matter!

BTW, since you’re not a 1-percenter, then you don’t have to worry about the tax anyway, dummy! The 46% made up of the standard capital gains PLUS earned income that we all pay when we buy and sell securities for a profit (just like under Trump). If you make >$1MM per year total, the effective standard income tax rate you would pay on income OVER $1MM plus the standard cap gains tax would equal just over 46%. Do you get it now??? IT ONLY AFFECTS THE VERY RICH!

Still shaking my head that you dug up that article from 30 years ago….

OK back to the basicsI’m gonna go out on a limb and bet that you were not the captain of your debate team. My god you’re dense.

You start your thread talking about Kamala taxing capital gains, then you post an article from 1995? Proving the capital gains taxes have been around through many previous presidents…..

Ya, no shite you’re not an English major, or any other major for that matter!

BTW, since you’re not a 1-percenter, then you don’t have to worry about the tax anyway, dummy! The 46% made up of the standard capital gains PLUS earned income that we all pay when we buy and sell securities for a profit (just like under Trump). If you make >$1MM per year total, the effective standard income tax rate you would pay on income OVER $1MM plus the standard cap gains tax would equal just over 46%. Do you get it now??? IT ONLY AFFECTS THE VERY RICH!

Still shaking my head that you dug up that article from 30 years ago….

Ever own a business?OK back to the basics

When taxes are cut, which includes Capitol Gains tax, it advances production, keeps people employed, and increases 401K’s. Profits are recycled back into the market from the top down. Ever own a business?

www.forbes.com

www.forbes.com

Let me know how the bake sale goes to pay for, streets, highways, military, first responders, clean water, etc etc etc.Well that’s great. You can afford to be a liberal democrat.

Being in the furniture business you probably sell a lot of goods to people moving to Arizona I assume.

Hard working middle class folks running from high tax states such as Kalifornia.

The US becoming a high tax nation forces companies overseas.

Taxes are bad. Overspending is even worse.

It’s the economy stupid.

Yeah, the global economy, stability, etc. are another things you know jack chit about.Yes it takes money to run a country or even a small business.

The problem is Washington want to run the world. You will need to sell a lot more cookies at your Democrat bake sale.

Let me know how that goes cupcake

If you’re so smart. Why are you on this message board?Yeah, the global economy, stability, etc. are another things you know jack chit about.

Throw another dozen cookies in the oven.

Sure, and anyone with a single firing brain cell is up 17% YTD...If you’re so smart. Why are you on this message board?

Stupid is as stupid does.

It’s the economy stupid.

Well that’s great. You can afford to be a liberal democrat.

Being in the furniture business you probably sell a lot of goods to people moving to Arizona I assume.

Hard working middle class folks running from high tax states such as Kalifornia.

The US becoming a high tax nation forces companies overseas.

Taxes are bad. Overspending is even worse.

It’s the economy stupid.

Go look in the mirror for your answer.One question Buzzy

What is a woman ?

Ok puzzyGo look in the mirror for your answer.

So you're saying it's bad to be different than China??? You freaking commie!!Harris’s economic proposal would also raise the capital gains and dividends tax more than twice as high as China’s, or 44.6 percent. China has a capital gains tax of 20 percent.

Report: Kamala Harris Wants to Boost Taxes by $5 Trillion

Vice President Kamala Harris's economic plan would increase taxes by $5 trillion over ten years, according to Americans for Tax Reform (ATR).www.breitbart.com

wetmule, has nailed it on the head, it is easy to say I am only going to tax the rich, and just like azhunter most only look at income tax.Just for the rich always expands & applies to more & more people. Via ratifying the 16th Amendment, the 1913 income tax was originally for the top 1% of earners. Over time the government applied it to more and more people growing the tax base.

Our founders fought a revolution in large part to being taxed without representation. Tea Party

They just want to stick it to the rich. Is that why they passed a bill to hire 87,000 new IRS agents while at the same time attempting to tax any PayPal, Venmo, Zelle transaction over $600?

As usual, wetmule posted wise words.wetmule, has nailed it on the head, it is easy to say I am only going to tax the rich, and just like azhunter most only look at income tax.

Hummm, good question.So since I'm taxed on unrealized gains, do I deserve a refund when I sell the asset at less than the government appraisal?

You make your own estimate. Didn’t you pay attention to trumps NY case?. And yes, you deduct capital losses.So since I'm taxed on unrealized gains, do I deserve a refund when I sell the asset at less than the government appraisal?

You make your own estimate. Didn’t you pay attention to trumps NY case?. And yes, you deduct capital losses.

Do you guys really think the “rich” have a higher effective tax rate than you? Open your eyes.

Tax the uber rich to the hilt and leave the middle class alone.

Please don’t be another whiney azz rich dude.That's great.

I bought this house when I was 20.

I'll get taxed on the gains for 40-50 years, and then hope it's a down year when it sells? Seems great.

The Uber rich don't pay taxes because there are politicians.

Want to tax the rich, term limits.

Please don’t be another whiney azz rich dude.

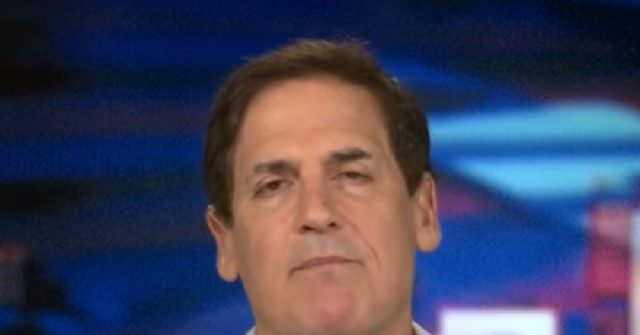

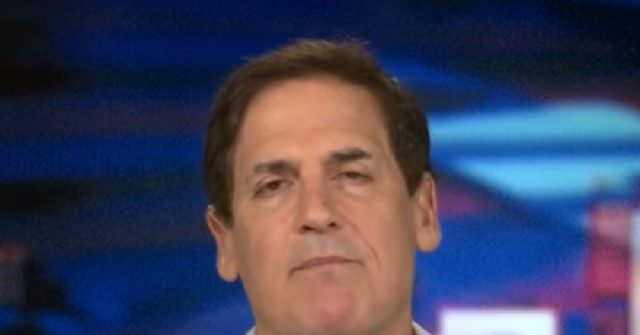

Yet he approves of her planKamala’s plan would kill the stock market

Cuban: Kamala's Capital Gains Tax Plan Would 'Kill the Stock Market'

Billionaire investor Mark Cuban warned Thursday on CNBC's "Squawk Box" that Vice President Kamala Harris' capital gains tax plan would "kill the stock market." | Clipswww.breitbart.com

Isn’t that a typical dem though? They don’t approve, know it’s the wrong approach, and destructive, but vote for the person in charge of it anyway? I just thought that was their standard playbook. Kind of like 75%+ of people say their life was better under Trump yet…..Yet he approves of her plan